Scotforth Performance Statistics - Dec 2017

An important part of Scotforth’s confidence in making EXPLORATION and DRILLING SUCCESS predictions is knowledge of the likely SURVEY EFFECTIVENESS rating of our surveying in any particular geography, basin and / or play environment.

Developing and integrating this attribute into our DHM prospect specific assessments of “Chance of Success” or “PD”(Probability of Discovery) metrics in new surveys and prospectivity forecasts add further “edge” to the incisiveness of our exploration methodology, particularly also as it typically includes similar internal geological rating of the conventional petroleum systems in the surveyed area of interest. Taken together, this integrated exploration process generates expected high confidence, realistic overall PD forecasts for the DHM targets.

Development of this Survey Effectiveness “know how” is continuously evolving as we continue our R&D world-wide. We achieve it through combination of both “Pre-drill Predictive” DHM and post-drill DHM “Back test” analysis of industry drilling results and proven fields wherever possible.

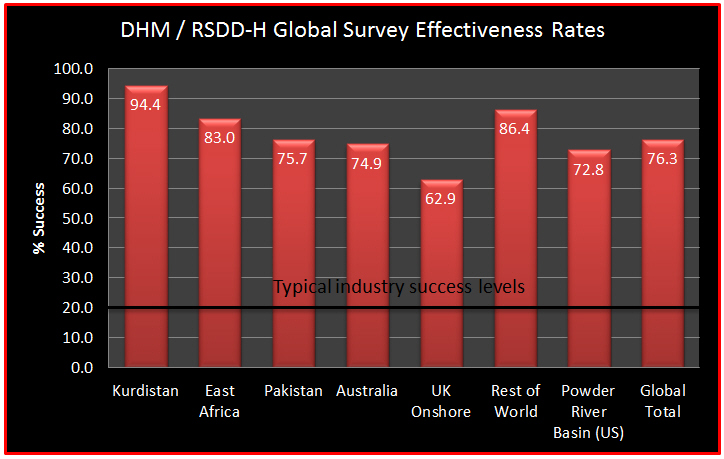

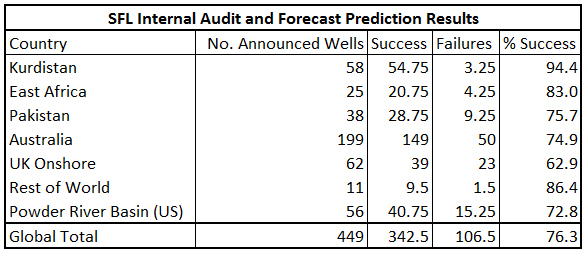

Here today, our illustrative “effectiveness” inventory comprises the results of 449 wells drilled in more than seven widely separate geographies and petroleum habitat settings. These effectiveness patterns are considered representative of the effectiveness range identified more globally by Scotforth over the years in its much broader and deeper total well population “calibration” assessments across more than one hundred basins and fifty countries in all continents. This empirical, growing factual evidence is increasingly powerful and compelling.

The combination of these DHM case studies along with exploration venture results, sole risk and client placed surveys mean that our capabilities and confidence grows from day to day.

While by no means providing an exploration risk panacea, the DHM exploration process, under-pinned by Scotforth’s unique proprietary RSDD-H imagery processing appears to be a game-changer. The statistics of DHM efficacy continues to grow across ever more geography, basins and oil and gas habitats – as the following cameo statistics portray:

I. Drilling Back Tests

Scotforth has carried out an extensive “well audit” of industry drilling versus RSDD-H based anomaly mapping over recent years, analysing and articulating how known, announced well results (successes and failures) position versus RSDD-H observations and DHM analysis. For example, do producing wells sit on an RSDD-H anomaly and are Dry Holes located off anomaly?

Discrete Exploration Prospect Tests:

Our performance against individual “first well” exploration tests is perhaps the truest indication of our potential predictive performance both regionally and globally. Put simply, do these critical wells sit on or off anomaly and do their results then correspond with our expectations?

Within our current illustrative total population of 449 wells (all categories), 230 are individual “first well” prospect tests in which our DHM analysis successfully corroborates well results 77% of the time. This has huge implications for the exploration risk investment decision process.

II. Industry Pre-Drill Prognoses:

Recognising that back test results are only a post-event internal “audit”, Scotforth determined to test further the efficacy of RSDD-H based DHM surveying by preparing a set of forward pre-drill predictions of future planned industry exploration well tests. These DHM prognoses were circulated to selected independent investors and industry representatives in February 2015 and have been monitored progressively as new well results were announced on completion of drilling by the operators.

Result – better than 84% prediction success in the 11 announced results.

III. Combined Total Well Analysis:

In addition to the foregoing (extracted) highly important “first well” exploration tests evidence (back tests and reported pre-drill prediction results), the balance of Scotforth’s illustrative population of wells comprises (as far as can be identified) a mix of early Discovery Appraisal wells and Field Development wells in producing basins around the world. These wells make up the balance of our “all categories” total 449 well inventory that yields a consolidatedglobal DHM / RSDD-H survey effectiveness of 76.3%.

This Survey Effectiveness pattern typically translates into full survey integrated DHM PDprognoses for top ranking prospects in survey areas of more than 60%, rising on occasions to more than 70%. In the other direction, it can reduce the pre-drill PD expectation of conventionally developed exploration prospects to less than 10% where no hydrocarbon evidence is present in DHM – and accordingly provide timely added consideration as to whether such features merit drilling or further investment.

In our industry with its low success, onshore exploration drilling statistics, introduction of DHM to the prospect development process can materially enhance plays, prospects and lands and seriously influence and improve the related risk investment decision process.

If you believe DHM could assist your business development programs do let us know: This email address is being protected from spambots. You need JavaScript enabled to view it.

[Further information behind how we calculate our stats, factors affecting our performance and survey implications, are provided in our detailed statistics document.]